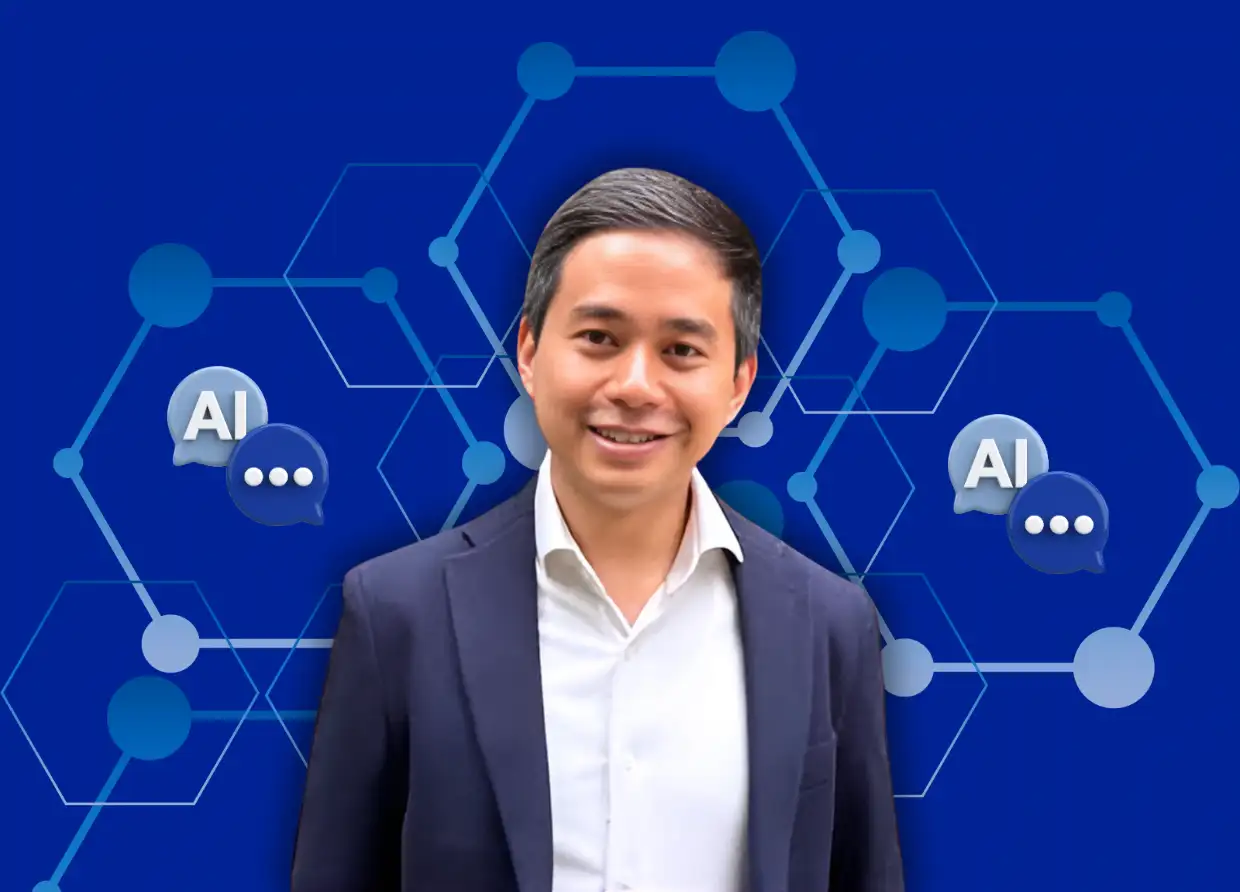

GABRIEL FRANS AND HIS QUEST TO HELP SMES KEEP THEIR BOOKS

How Gabriel assists SMEs with their bookkeeping with his proprietary tool.

Technology's fast growth has changed civilization. The internet has completely changed user behavior and media consumption. These shifts pushed marketers to adapt. Advertising, too, is no longer limited to print.

The advertising landscape has changed because of the internet. In the early 1990s, there was no money spent on digital ads. However, by 2025, digital advertising is expected to reach $500 billion (Rp 71.64 trillion) around the world.

View this post on Instagram

In 2017, Total ad spending in Indonesia was the highest in the Asia Pacific, beating China and Singapore, according to eMarketer. Indonesia's spending on digital advertising was estimated to exceed Rp 37 trillion in 2019.

Many micro, small, and medium-sized businesses (MSMEs) emerge every day, but many fail. Poor financial management is one of the main reasons.

The belief that the size of one's business is still relatively tiny is typically the reason why SMEs ignore keeping proper financial records. The truth is, however, updating financial records should be done right from the inception of a business.

Financial data can help business players decide whether to invest in manufacturing equipment, recruit more employees, or enact other policies. Regrettably, the lack of accounting knowledge might impair business actors' appreciation of the importance of financial data.

Accounting-compliant financial reporting can be overwhelming for even highly educated entrepreneurs, leading to poor financial literacy. This prompted Gabriel Frans to start CrediBook in February 2020.

"CrediBook is an all-in-one tool for managing a lot of different financial transactions... [It may help] MSMEs to increase their production," Gabriel says.

More than half of the people who use this MSME digital bookkeeping service in Indonesia live in Tier 2 and 3 cities. In response, CrediBook initiated CrediMart, a web-based online wholesale store that business owners can use to get the stock they need.

"We introduced CrediMart, an online wholesale store that allows MSMEs to shop for item stock without leaving their business," Gabriel said.

Solution for the community

Gabriel said the CrediBook idea was born out of concern regarding the state of MSME players in his community, such as conventional hawkers.

"There's a lot of them, but their growth is slow. So we attempted to figure out their obstacles, starting with the most fundamental — financial records," he explained.

According to Gabriel, SMEs usually do not keep their books properly, if at all. "Financial records are the foundation of a business; if they are not kept properly, it would be more difficult for SMEs to make business judgments," he explained. SMEs might also need these records if they ever need venture capital from a financial institution.

"At first, we were still focused on recording debt because this is a normal practice among MSMEs. Users were overjoyed at the time because their debt records were cleaner, and they didn't have to worry about forgetting anything. Then, over time, we add new features that clients require," he said.

Creating ecosystems

Unlike other platforms, CrediBook not only records but also connects customers, sellers and distributors. Users can also use CrediBook to make bill payments, reducing the need for manual recording and confirmation.

"We are building an ecosystem wherein customers, sellers, distributors, and wholesalers can all be connected through a single platform," Gabriel said. "Furthermore, we provide consumers with the ability to apply for a capital loan to expand their business."

The CrediBook application now includes more comprehensive functions, such as the ability to record daily transactions, record capital, pay bills or financial activities in the application, and apply for a company capital loan (CrediLoan).

CrediBook is now working on solving problems in the wholesale industry, whereas this marketing strategy tries to increase the loyalty of CrediBook consumers.

According to Gabriel, another step for CrediBook would be to engage with existing conventional wholesale stores rather than brands or product principles to enable wholesale MSMEs to earn extra money rather than replace their position.

"We envision CrediBook and CrediMart serving as a digital operating system for wholesalers. CrediBook specializes in accountancy, while CrediMart specializes in sales," he said.

#THE S MEDIA #Media Milenial #credibook #gabriel frans #indonesian startup